Why choose Inovayt?

You come first

One size doesn’t fit all. We’re flexible to your individual needs and situation.

Expert experience

Over 15 years of experience in Australia’s most competitive markets.

Move quickly

Loan approvals in as little as 4 hours with our dedicated team.

Save money

We find the best rate for you from over 40+ leading lenders.

Why choose Inovayt?

You come first

One size doesn’t fit all. We’re flexible to your individual needs and situation.

Expert experience

Over 15 years of experience in Australia’s most competitive markets.

Move quickly

Loan approvals in as little as 4 hours with our dedicated team.

Save money

We find the best rate for you from over 40+ leading lenders.

Discover Melbourne's Premier Mortgage Brokers

At Inovayt, we’re proud to be redefining mortgage and finance brokering in Melbourne. Our dedicated team of mortgage brokers in Melbourne are committed to delivering a seamless and personalised home loan experience to each of our clients.

In a city as dynamic as Melbourne, having a knowledgeable and trustworthy mortgage broker by your side is crucial. Inovayt is the go-to brokers in Melbourne for those in need of expertise. Contact us today to embark on your journey to homeownership with the guidance of Melbourne’s finest mortgage brokers.

How do we work?

4 easy steps to get your foot in the door

Discovery

We know that one size doesn’t fit all. Let us take a moment to establish your individual financial goals.

Submission

After reviewing your financial position, we’ll provide you with the best options to make your decision.

Approval

Once approved by your chose lender, we finalise approvals and organise formal paperwork for sign off.

Settlement

We’ll carry out the settlement process for you with ongoing support.

Are you a first home buyer in Melbourne?

Buying your first home is a day many of us dream of. At Inovayt, we take you through your very own finance journey, from the time that buying a home is simply a dream right up until settlement. We appreciate that everyone’s on a different path so we will tailor the solution to you.

Are you ready to buy your next home?

Have you found your dream family home, or are you ready to renovate your current home? When it comes to what’s next on your homebuyer journey, we’ll walk you through your options of whether it’s best to purchase or renovate. We can also assist you with the decision to sell or rent your current home.

Are You Ready to Refinance with a Leading Melbourne Mortgage Broker?

If it has been over two years since you last reviewed your mortgage, consider this a pivotal moment to reassess your financial standing. At Inovayt, we understand that a mortgage is not a static commitment—it should evolve as your life does. As your dedicated Melbourne mortgage broker, we are here to ensure that your mortgage continues to meet your changing needs and circumstances. Refinancing can offer a multitude of benefits, from lowering your interest rates to adjusting your loan terms, or accessing home equity for major purchases or renovations. As experienced finance brokers in Melbourne, we provide expert guidance and a seamless refinancing process tailored to your specific requirements.

Embarking on Your First Home Buying Adventure in Melbourne?

Dreaming of buying your first home in Melbourne? At Inovayt, we understand that this journey is more than just a transaction; it’s a milestone. As a premier mortgage broker in Melbourne, we’re dedicated to guiding you through every step of your home-buying adventure. From the initial dream of homeownership to the moment of settlement, our approach is tailored uniquely to you. Recognising that each journey is distinctive, our team of expert finance brokers in Melbourne crafts solutions that are as individual as your dreams.

Home Loan Broker in Melbourne – Plan Your Next Big Move in Homeownership

If you’re looking to step into your next dream family home in Melbourne, or contemplating a renovation to rejuvenate your current abode, Inovayt is here to illuminate your path. As seasoned mortgage brokers in Melbourne, we navigate you through the critical decisions – whether to buy anew, renovate, sell, or rent. Our expert mortgage and finance advisors in Melbourne offer insights and options, ensuring your next move in the property market is as rewarding as it is exciting. Let us partner with you in turning your next homebuyer aspiration into a vivid reality.

Why Choose Inovayt as Your Mortgage Broker in Melbourne?

Local Expertise, Global Insight: As finance brokers in Melbourne, we have a profound understanding of the local property market, combined with global financial insights. This unique blend ensures you receive advice that’s not just relevant but also forward-thinking.

Your Journey to Home Ownership, Guided by Melbourne’s Mortgage Broker

At Inovayt, we don’t just facilitate mortgages; we build lasting relationships that help turn your property dreams into reality. Our commitment to excellence and personalised service makes us more than just a mortgage broker in Melbourne; we are your partners in navigating the path to your perfect home. Embrace a stress-free, transparent, and successful home loan experience with the experts at Inovayt. Let’s make your Melbourne homeownership dream come true, together. Contact us today and take the first step towards a future filled with possibilities thanks to your dedicated Melbourne mortgage broker.

Mortgage Brokers in Melbourne - FAQs

Finance can often be tricky to get your head around. We know you generally have many questions that need answering, so we’ve put together our most asked questions for you.

How quickly can Inovayt secure a home loan approval in Melbourne?

Inovayt offers fast home loan approvals, with the possibility of securing approval in as little as 4 hours. Our efficient process ensures you can move forward with your home purchase or refinancing plans without unnecessary delays.

What kind of rates can I expect from Inovayt when looking for a mortgage in Melbourne?

Inovayt provides competitive rates from over 40 lenders. Our strong industry relationships and comprehensive understanding of the market allow us to negotiate the best possible terms for your mortgage, ensuring you receive a rate that is both competitive and suited to your financial situation.

How does Inovayt tailor its mortgage brokering services to individual needs in Melbourne?

Our mortgage brokers in Melbourne are committed to providing a personalised service. We take the time to understand your unique circumstances, financial goals, and property aspirations, tailoring our mortgage solutions to align perfectly with your needs. This personalised approach ensures that every client receives a bespoke service that truly reflects their individual requirements.

Can Inovayt assist with more complex mortgage needs such as refinancing or buying a second home in Melbourne?

Absolutely, whether you're planning to refinance your mortgage, buy your next dream home, or even undertake significant renovations, Inovayt is equipped to guide you through these complex decisions. Our mortgage and finance brokers in Melbourne offer expert insights and a range of options, helping you make informed decisions that best suit your evolving needs.

Why should I choose Inovayt as my mortgage broker in Melbourne?

Choosing Inovayt as your mortgage broker in Melbourne means partnering with a team that combines local expertise with a commitment to excellence. We are not just brokers; we are your trusted advisors, dedicated to achieving your financial goals with integrity and a commitment to long-term success. Our transparent process, tailored solutions, and continuous support make us the ideal partner in your journey to homeownership.

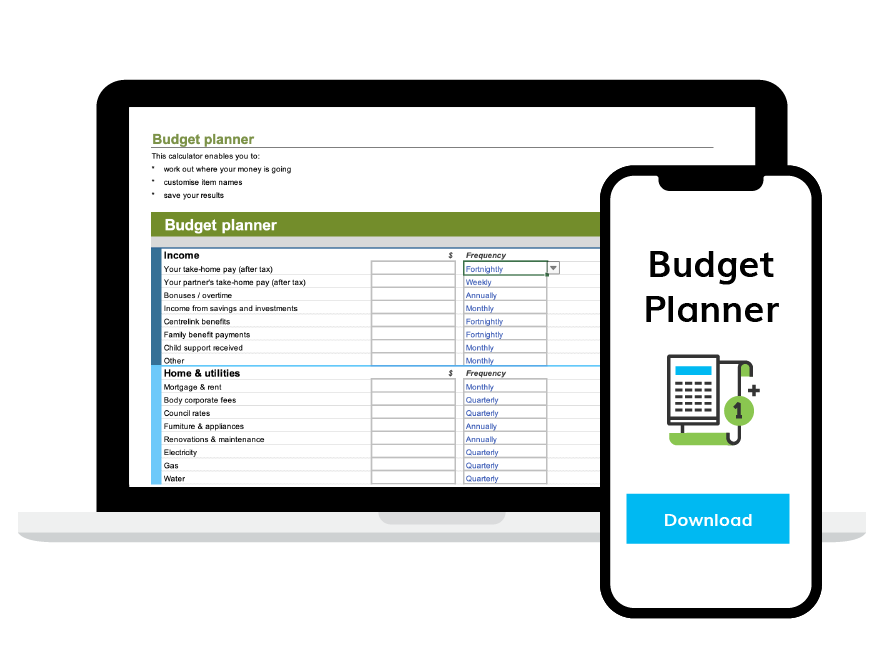

Online Finance Guides

Meet our Melbourne Mortgage Brokers

Meet our Melbourne Mortgage Brokers