Upgrading your home: should you sell or keep your current property?

Many second-home buyers who may feel as though they have outgrown their current property are faced with this conundrum. Do I sell my current home and cash out or do I hold my current property and turn it into an investment?

Should you sell or hold?

Whether you should buy or hold comes down to both personal and financial circumstances.

These are the items you will need to discuss with a mortgage broker in advance before being able to make a clear decision to sell or hold.

- Borrowing Capacity – if you need to upgrade your owner-occupied property for a larger place, generally you need to spend more so an income to borrowing capacity calculation will give you an indication of whether you have the income to support the new debt and existing debt in the eyes of the lender.

- Equity/Deposit – It’s important to discuss how much equity you maintain in your current property if you don’t sell your current home. Depending on your debt to property value ratio’s you may have less of a deposit towards the new purchase. This could result in Mortgage Insurance costs and higher interest rates if not addressed upfront. So, you may need to sell if you need the full cash amount to put towards the new purchase depending on your circumstances.

- Repayments/Personal risk appetite – if you have the borrowing capacity and the equity or deposit to hold your property then you need to make sure your circumstances and budget allow you to afford the cash flow on taking on more debt.

Now, if you and your broker have ticked all the boxes then you may have the ability to hold both properties.

To show an example of how selling or holding can impact your future wealth, we have positioned a common scenario that people face.

Scenario

Johnny and Sarah have sat down with their finance broker and run the numbers on their borrowing capacity, equity and risk appetite with repayments and feel like they would like to purchase a property for $900,000.

Johnny and Sarah have been married for 2 years and have 2 kids, they are now beginning to outgrow their property and would like to upgrade to a larger home.

Current property

Value: $700,000 (purchased for $400,000)

Loan $350,000

Johnny and Sarah “I can’t believe that we could sell for $700,000, that means we could make $300,000 if we sold”

This is a rational thought, yet before making a rational decision to sell, let’s understand if we can first do it without selling and secondly are there any long-term benefits to holding?

SELLING & BUYING

Firstly, the calculation on how much profit you make when you sell

|

Total Profit |

$350,000 |

|

Stamp Duty Paid Initially |

$6,000 |

|

Selling costs |

$14,000 |

|

Deposit put in initially |

$40,000 |

|

Total Cost |

$60,000 |

|

Actual profit after sale |

$290,000 |

|

Plus initial deposit back |

$40,000 |

|

Total |

$330,000 |

New Purchase

|

Purchase Price new property |

$900,000 |

|

New Loan |

$610,000 |

Johnny and Sarah “Great, well done guys we have upgraded our property, onto the next one”

Holding, turning a current home into an investment property and purchasing a new place.

How it works:

By using the equity in your current property, you can borrow against that.

You can get some tenants into your property once you move out, which will mean the following.

|

Repayments on existing Loan |

$202 Per week @ 3% interest Only |

|

Rental Income |

$400 Per week |

After buffering in some holding costs (20%), let’s say the rent places money back in your pocket that can help you pay off the additional debt you have acquired on paying down your new home.

$400pw @ 80% (after rental costs, insurance, rate etc) = $320 pw minus existing loan repayment $202 = $118 surplus cash per week x 52 weeks = $6,136 per annum.

That’s $511.33 per month of additional cash to place towards your new upgraded home and loan.

New purchase

|

Purchase Price: |

$900,000 |

|

New Loan |

$946,000 |

|

Costs (Lenders Mortgage Insurance) |

$6,000 |

Johnny and Sarah. “So we are okay with what the repayments would be on that, but were scared of that figure, of borrowing so much.”

That is completely understandable, but let’s break this down and understand what we know;

- Your income can support the new loan and you have the ability to hold this property long term.

- It costs you $6,000 in insurance fees to hold.

- You won’t be incurring the $14,000 sale cost to sell.

Now here is the real benefit to holding for someone. Compounding growth By selling your property, yes you have a lower loan and more cashflow. However, you have sold an asset worth $700,000 which you now do not own, and therefore you will not be able to get the future gains that this property may get into the future.

In

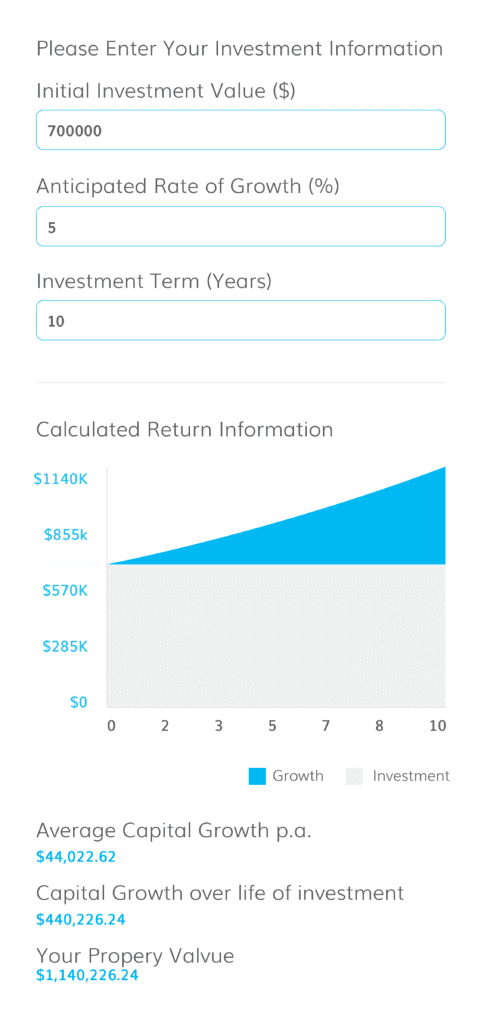

At a conservative growth rate of 5%, here would be the money that you are sacrificing by selling.

What the above image demonstrates is at a 5% capital growth rate on the property you sold, which is conservative on past growth rates, you will make $440,226 in 10 years for doing nothing.

If we apply that same 5% Capital growth on the Upgrading Home Purchase of $900,000 (with a total cost of $952,000) in 10 years you would have the upgraded home value of $1,540,000 in 10 years.

That’s a $588,000 increase on the upgraded home and a $440,226 win on the previous home turned investment.

Johnny and Sarah are now equity millionaires at $1,028,226 gain!

If you would like to speak with a professional to decide if you should sell or hold, get in touch with an Inovayt financial advisor today.