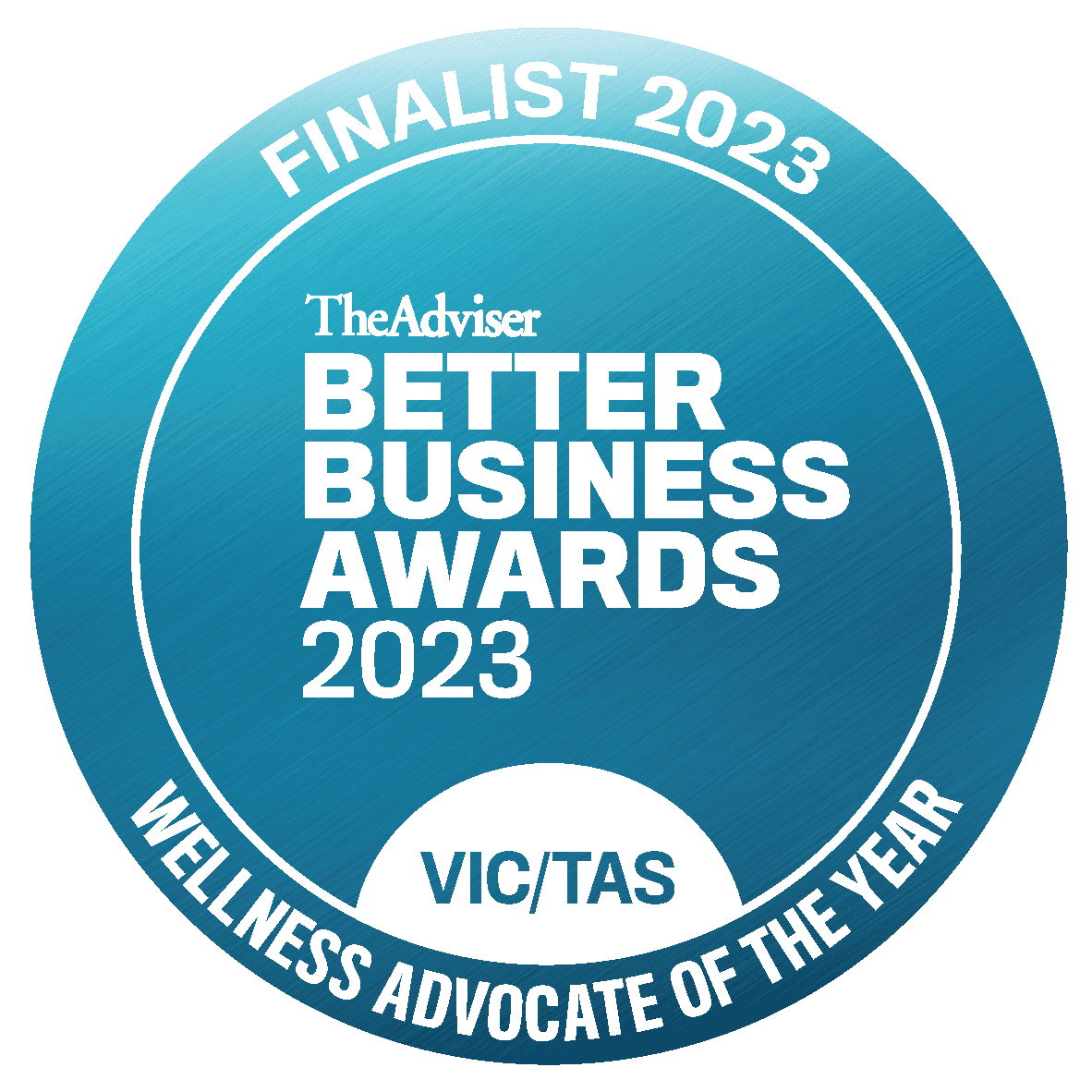

Your dream asset is within reach with the team at Inovayt

Bringing dreams to life

From personal vehicles to business equipment, let our team of expert brokers make your dreams come true

Unmatched access

Gain access to over 25 lenders with varying products and offers to find the right fit.

Flexible solutions

Our team offer a variety of solutions, such as low doc and no doc funding options, with loans approved in as little as 4 hours.

A team who care

Our team cares about the outcome of your financial goals, so we’ll go above and beyond to help you succeed.

Your dream asset is within reach with the team at Inovayt

Bringing dreams to life

From personal vehicles to business equipment, let our team of expert brokers make your dreams come true

Unmatched access

Gain access to over 25 lenders with varying products and offers to find the right fit.

Flexible solutions

Our team offer a variety of solutions, such as low doc and no doc funding options, with loans approved in as little as 4 hours.

A team who care

Our team cares about the outcome of your financial goals, so we’ll go above and beyond to help you succeed.

How do we work?

4 easy steps to get your foot in the door

Discovery

We know that one size doesn’t fit all. Let us take a moment to establish your individual financial goals.

Submission

After reviewing your financial position, we’ll provide you with the best options to make your decision.

Approval

Once approved by your chose lender, we finalise approvals and organise formal paperwork for sign off.

Settlement

We’ll carry out the settlement process for you with ongoing support.

Central Coast business asset finance

Business assets are a fundamental part of any successful business. Whether you’re upgrading assets to promote growth, fixing existing assets to maintain efficiency, or replacing old and damaged assets, our expert team can help you find the solution that is just right for you and your business.

Exploring chattel mortgages

Depending on the needs and type of your business, a chattel mortgage could be a viable option for you. Chattel mortgages use the purchased asset as collateral against the loan, however, it is only available to specific assets (not a property, for example). Speak to one of our specialised teams to find out more or if this is suitable for you.

Low doc loan

While full and low doc loans function in the same way, it is the criteria of acceptance that separates the two. Low doc loans are generally for established businesses that have a long-term ABN and GST registration. This allows the loan approval process to be fast-tracked, allowing you to take advantage of any opportunities to grow quicker.

Understanding commonly asked questions

Understanding the finer details of personal financing and business financing might be a bit overwhelming at first, but that's why we’re here to offer advice and guidance along the way.

What are the benefits of asset finance?

Asset finance is a great option if you want to get your new asset without the wait. This option allows you to obtain larger assets through hire or lease without purchasing the asset outright. There are many benefits of asset finance for both business and personal use.

- The potential to reduce larger loan costs

- Can free up capital

- allows you to improve your cash flow

- Gets you your new asset faster

What is equipment finance?

Equipment finance is the perfect solution for businesses that rely heavily on machinery tools and equipment to operate. This financial option can be used for a range of things, including:

- Work tools

- Trade tools

- Office computers

- Heavy machinery

- Farming equipment

What is a balloon payment?

A balloon payment is the lump sum of money owing at the end of your loan. It’s often an option used by borrowers to reduce their monthly repayments across the span of the loan. The terms of your loan, including your balloon payment, can be negotiated with your lender.

What is the maximum balloon I can have?

Balloon repayments differ based on your chosen lender. The maximum amount of money you’ll pay in your balloon payment is capped at 50 per cent of the loan amount, meaning, if you have a 50 per cent balloon on a $30,000 car loan, you will pay a balloon payment of $15,000 after your loan term.

What are the term conditions?

Asset finance is perfect for those who want to get their new asset sooner. The longest loan you can have for this financial solution is seven years, but be wary that you’ll pay more interest the longer your loan.

Car loan vs novated lease – what’s the difference?

Novated leases and car loans have similar features and some key differences. These include the following.

- Regular repayments are made for both.

- Balloon payments are an option at the end of each loan.

- A novated lease is a three-way deal between you, the lender, and your employer.

- You own the vehicle from day one with a regular car loan.

- Once the loan term ends on a novated lease, and the balloon payment has been repaid, you own the vehicle.

- After-tax earnings are used to finance a car loan, whereas pre and post-tax pay are used for a novated lease.

Online Finance Guides

Meet our Central Coast Asset finance brokers

Meet our Central Coast Asset finance brokers